United Kingdom¶

Configuration¶

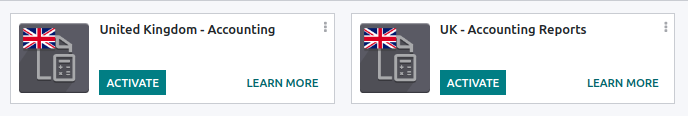

Install the UK - Accounting and the UK - Accounting Reports modules to get all the features of the UK localization.

Name |

Technical name |

Description |

|---|---|---|

UK - Accounting |

|

|

UK - Accounting Reports |

|

|

Note

Only UK-based companies can submit reports to HMRC.

Installing the module UK - Accounting Reports installs all two modules at once.

Chart of accounts¶

The UK chart of accounts is included in the UK - Accounting module. Go to to access it.

Setup your CoA by going to and choose to Review Manually or Import (recommended) your initial balances.

Taxes¶

As part of the localization module, UK taxes are created automatically with their related financial accounts and configuration.

Go to to update the Default Taxes, the Tax Return Periodicity or to Configure your tax accounts.

To edit existing taxes or to Create a new tax, go to .

See also

Making Tax Digital (MTD)¶

In the UK, all VAT-registered businesses have to follow the MTD rules by using software to submit their VAT returns.

The UK - Accounting Reports module enables you to comply with the HM Revenue & Customs requirements regarding Making Tax Digital.

Important

If your periodic submission is more than three months late, it is no longer possible to submit it through SotaERP, as SotaERP only retrieves open bonds from the last three months. Your submission has to be done manually by contacting HMRC.

Register your company to HMRC before the first submission¶

Go to and click on Connect to HMRC. Enter your company information on the HMRC platform. You only need to do it once.

Note

When entering your VAT number, do not add the GB country code. Only the 9 digits are required.

Periodic submission to HMRC¶

Import your obligations HMRC, filter on the period you want to submit, and send your tax report by clicking Send to HMRC.

Periodic submission to HMRC for multi-company¶

Only one company and one user can connect to HMRC simultaneously. If several UK-based companies are on the same database, the user who submits the HMRC report must follow these instructions before each submission:

Log into the company for which the submission has to be done.

Go to General Settings, and in the Users section, click Manage Users. Select the user who is connected to HMRC.

Go to the UK HMRC Integration tab and click Reset Authentication Credentials or Remove Authentication Credentials button.

You can now register your company to HMRC and submit the tax report for this company.

Repeat the steps for other companies’ HMRC submissions.

Note

During this process, the Connect to HMRC button no longer appears for other UK-based companies.