Checks¶

There are two ways to handle payments received by checks in SotaERP, either by using outstanding accounts or by bypassing the reconciliation process.

Using outstanding accounts is recommended, as your bank account balance stays accurate by taking into account checks yet to be cashed.

Note

Both methods produce the same data in your accounting at the end of the process. But if you have checks that have not been cashed in, the Outstanding Account method reports these checks in the Outstanding Receipts account. However, funds appear in your bank account whether or not they are reconciled, as the bank value is reflected at the moment of the bank statement.

See also

Outstanding accounts

Method 1: Outstanding account¶

When you receive a check, you record a payment by check on the invoice. Then, when your bank account is credited with the check’s amount, you reconcile the payment and statement to move the amount from the Outstanding Receipt account to the Bank account.

Tip

You can create a new payment method named Checks if you would like to identify such payments

quickly. To do so, go to ,

click the Incoming Payments tab, and Add a line. As Payment

Method, select Manual, enter Checks as name, and Save.

Method 2: Reconciliation bypass¶

When you receive a check, you record a payment on the related invoice. The amount is then moved from the Account Receivable to the Bank account, bypassing the reconciliation and creating only one journal entry.

To do so, you must follow the following setup. Go to . Click the Incoming Payments tab and then Add a line,

select Manual as Payment Method, and enter Checks as Name.

Click the toggle menu button, tick Outstanding Receipts accounts, and in the

Outstanding Receipts accounts column, and set the Bank account for the

Checks payment method.

Payment registration¶

Note

By default, there are two ways to register payments made by check:

Manual: for single checks;

Batch: for multiple checks at once.

This documentation focuses on single-check payments. For batch deposits, see the batch payments documentation.

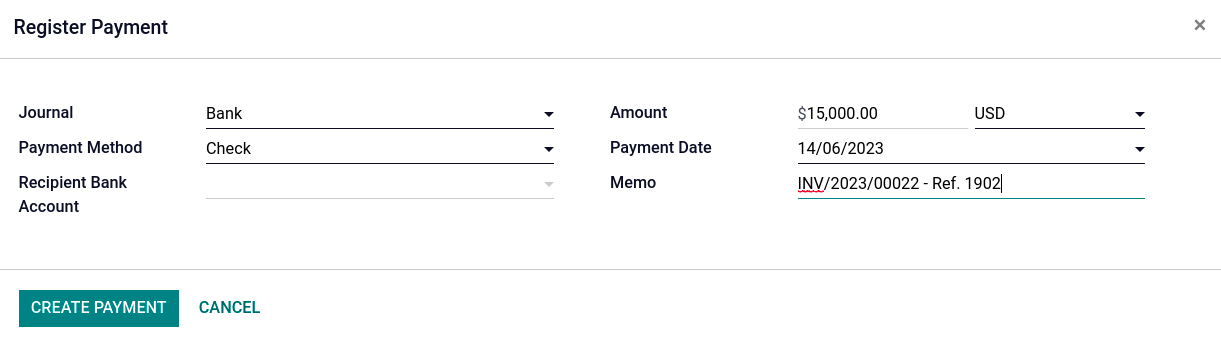

Once you receive a customer check, go to the related invoice (, and click Register Payment. Fill in the payment information:

Journal: Bank;

Payment method: Manual (or Checks if you have created a specific payment method);

Memo: enter the check number;

Click Create Payment.

The generated journal entries are different depending on the payment registration method chosen.

Journal entries¶

Outstanding account¶

The invoice is marked as In Payment as soon as you record the payment. This operation produces the following journal entry:

Account |

Statement Match |

Debit |

Credit |

|---|---|---|---|

Account Receivable |

100.00 |

||

Outstanding Receipts |

100.00 |

Then, once you receive the bank statements, match this statement with the check of the Outstanding Receipts account. This produces the following journal entry:

Account |

Statement Match |

Debit |

Credit |

|---|---|---|---|

Outstanding Receipts |

X |

100.00 |

|

Bank |

100.00 |

If you use this approach to manage received checks, you get the list of checks that have not been cashed in the Outstanding Receipt account (accessible, for example, from the general ledger).

Reconciliation bypass¶

The invoice is marked as Paid as soon as you record the check.

With this approach, you bypass the use of outstanding accounts, effectively getting only one journal entry in your books and bypassing the reconciliation:

Account |

Statement Match |

Debit |

Credit |

|---|---|---|---|

Account Receivable |

X |

100.00 |

|

Bank |

100.00 |